A significant shift has been occurring on grocery store shelves: the rise of private-label or “store-brand” products. Major supermarket chains—from Kroger and Walmart to Aldi and Trader Joe’s—are investing heavily in developing and promoting their own branded items, often at the expense of well-known third-party producers. For smaller food companies, this shift presents a critical moment: adapt or risk disappearing from the consumer’s line of sight.

The Rise of Private Labels

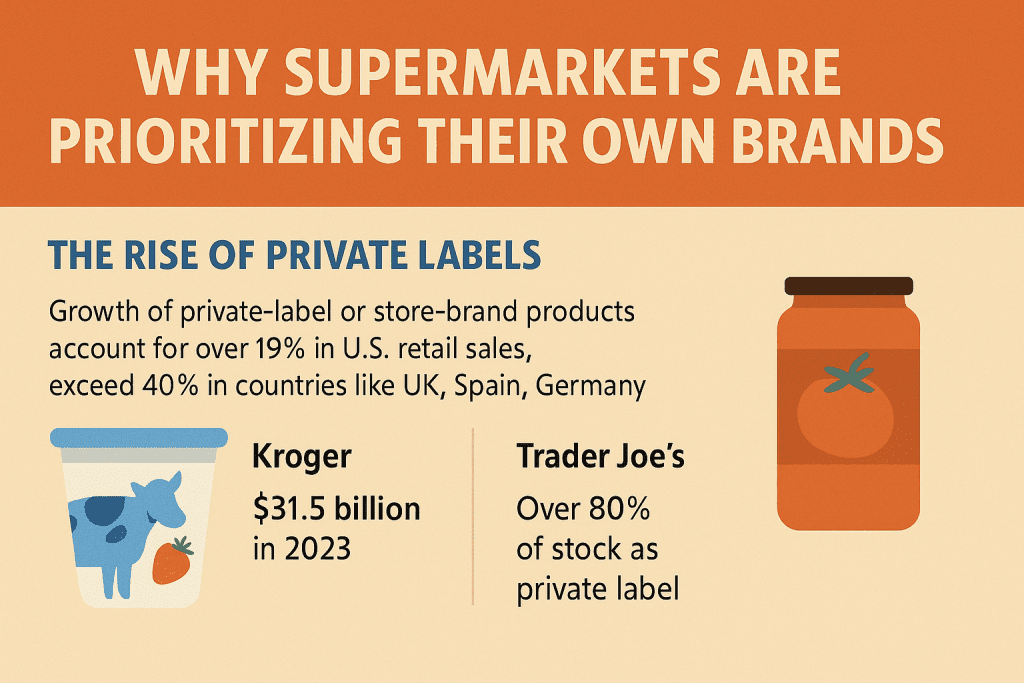

Private-label products are no longer just the budget-friendly, generic alternatives of the past. They have evolved into high-quality, premium, and even gourmet options. According to data from NielsenIQ, private label now accounts for over 19% of total U.S. retail sales and is growing faster than national brands in many categories. In Europe, the trend is even more pronounced, with private label reaching more than 40% market share in countries like the UK, Spain, and Germany.

In the U.S., retailers like Costco (Kirkland Signature) and Trader Joe’s have built cult followings for their house brands. Kroger’s “Our Brands” portfolio, which includes Simple Truth and Private Selection, generated over $31 billion in 2023, a 10% increase from the previous year.

Why this shift?

- Higher profit margins: Retailers have more control over pricing, manufacturing, and inventory with private labels.

- Consumer loyalty: Strong in-house brands drive customer return visits.

- Supply chain resilience: During the pandemic, retailers learned that owning the supply chain improves flexibility and security.

- Market positioning: Supermarkets can fill perceived gaps in product variety, sustainability, or health trends faster than big CPG firms.

Impact on Smaller Producers

For small food and beverage companies, losing shelf space is more than a logistical issue—it’s existential. Without access to physical distribution in major chains, brands risk vanishing from consumers’ awareness. And with retailers now functioning as both seller and competitor, it’s no longer a fair playing field.

So, what can these businesses do? It may be time to pivot from competing in crowded, price-sensitive markets to creating entirely new ones. Enter Blue Ocean Strategy.

Blue Ocean Strategic Thinking: A Path Forward

Small producers must rethink their value proposition not just as another version of a shelf item—but as something entirely different. Rather than competing on price, flavor, or package size, the opportunity lies in redefining the product category or the delivery model.

Strategies for Redesigning the Playing Field:

- Go Direct-to-Consumer (DTC)

The success of brands like Liquid Death and Magic Spoon illustrates the power of building a tribe outside traditional shelves. Online channels allow companies to control their narrative, pricing, and customer data. - Create Experiential or Purpose-Driven Brands

Think Tony’s Chocolonely, which markets not just chocolate but ethical sourcing and human rights. Their story is their product—and it resonates with a growing segment of conscious consumers. - Leverage Niche Retail and Subscription Services

Farmers markets, specialty food stores, and subscription boxes like Thrive Market or SnackMagic give small producers targeted visibility where customers are already seeking curated, unique products. - Develop Co-Branded Partnerships

Collaborating with chefs, influencers, or lifestyle brands can open new customer segments. For example, a small olive oil company might partner with a Mediterranean diet coach or create a line with a well-known food blogger. - Innovate in Packaging and Usage

Rather than selling salsa in a jar, what if it came as an on-the-go dip with crackers in compostable packaging? Reimagining form factors can turn familiar products into category-defying newcomers.

The Bigger Picture: Consumer Impact

While private labels often offer affordability, their dominance could limit diversity, innovation, and competition. Fewer small producers on shelves means fewer novel flavors, stories, and ideas in the marketplace. This could ultimately dull the consumer experience and reduce innovation incentives across the food industry.

At the same time, consumers benefit when small brands push boundaries through Blue Ocean strategies—whether it’s by bringing exotic flavors to suburban homes or introducing new ways to consume age-old ingredients.

Conclusion: Don’t Compete—Create

For smaller producers facing supermarket pushback, the message is clear: you don’t have to compete on the same terms. In a world where shelf space is shrinking, the smartest brands are creating their own stage. That might mean selling directly to a passionate niche, reshaping how consumers experience your product, or offering something so new there’s no comparison.

Supermarkets may be closing one door—but many more are opening for those willing to rethink the game.

To learn more about how Simon Associates helps companies find their Blue Ocean Strategy, check out our website: https://www.simonassociates.net/blue-ocean-strategy/ and read more about how exploratory research can open up those unmet needs of your customers.

Or read our white papers about how corporate anthropology and Blue Ocean Strategy fit so well together as we help you “see, feel, and think in new ways about your business today and into the future. This article about our Blue Ocean Expertise takes a dive into how we have applied BOS in business.

From Observation to Innovation,

CEO | Corporate Anthropologist | Author

Simonassociates.net

Info@simonassociates.net

@simonandi

LinkedIn