“Do mergers and acquisitions work in these challenging times ?”

?”

This is the apt question posed by Dr. Andrea Simon, principal and founder of Simon Associates Management Consultants (SAMC), in a recent blog published by Vistage International’s Executive Street. What if your growth strategy was to expand your business through acquisitions, only then to find your company in deep, “bloody red” water? You thought you were getting new revenue streams or better efficiencies. Instead, your new business is centered in a red ocean of bloody competition. Hence the title of her blog, “What if You Buy a Red Ocean?”

According to Dr. Simon, this isn’t a one-off but rather, an occurrence she finds happening all too frequently: as a business fails, another company acquires it…or as a growth strategy, a company tries to find a related business or industry in which to make an acquisition or a merger.

For mid-market companies, not global giants, there is little room for error in changing times, she says.

If you are thinking about an acquisition or a merger, the following examples of Blue Ocean® thinking might help you evaluate an upcoming decision with fresh eyes:

If you are thinking about an acquisition or a merger, the following examples of Blue Ocean® thinking might help you evaluate an upcoming decision with fresh eyes:

#1) In trying to find a nonuser and create new markets, it’s okay to stay in your current industry if you can add value in innovative ways. Will a merger bring you increased resources, new technology or new methodologies to apply to the problems you are currently solving? Is there real differentiating utility that you are bringing to the market through this consolidation? If no, rethink your strategy, and quickly.

#2) Maybe you are making an acquisition that will diversify your portfolio and expand your customer base. Great idea. But are you buying new value for those consumers or just duplicating solutions that others already have mastered? Did the company you’re buying fail because of activities that you can address, fast, or because there was too much supply and too little demand at the prices they were charging?

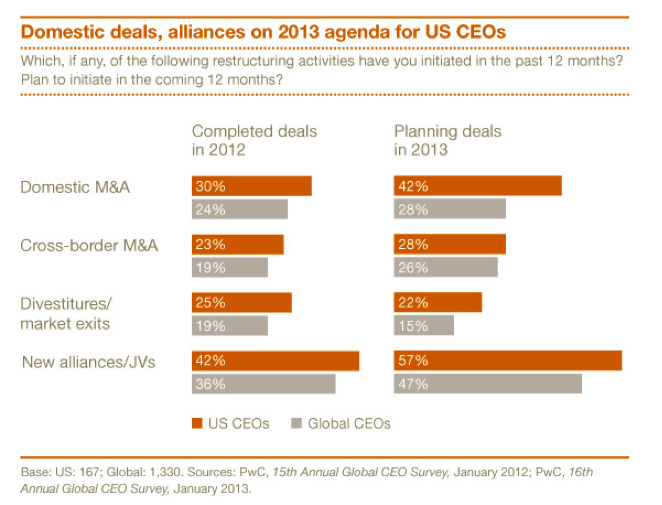

The recent publication of the PWC Annual Survey of CEOs is worth reading if you are thinking about a merger or acquisition as part of your growth plans for the next 1-3 years. As you see in the chart, the US CEOs are rather bullish on acquisitions compared with their global colleagues. PWC’s research suggests that these 1600 surveyed CEOs are focused in three major areas:

#1: Building resilience to disruption. Focus is on collaboration with partners and diversification.

#2: Taking the home-field advantage. Focus on the US market with consolidation for US customers.

#3: Siding with the customer. “Expect interest in predictive analytics and other customer-oriented strategies to keep growing. CEOs are setting the customer as their beacon to build businesses that last.”

Keep this in mind, Dr. Simon advises, as you focus on organic growth strategies in your current “red ocean,” expand your presence through a merger or acquisition in your same industry sector, or seek new “blue ocean” opportunities where you can create new market space, with or without buying or merging.

To read Andrea’s blog in its entirety on Executive Street, click here.

About Dr. Andrea Simon and Simon Associates Management Consultants

New York-based Simon Associates Management Consultants (SAMC) serves clients in a wide range of industries from manufacturing, OEMs, customer care, hospitals, and other healthcare institutions to colleges and service industry companies, among others.

One of the keys to SAMC’s success is helping the leadership at companies to “see, feel, and think” in new ways. For more information, visit www.simonassociates.net. You also can follow SAMC on Twitter (@andisamc) or Facebook.