If younger Gen X and Gen Y consumers could create their own “bank of the future” time machine to help guide them through their increasingly complex financial decisions, what would they create? How would that differ from bankers’ ideas? More technology? More mobile apps? More integrated asset management?

If younger Gen X and Gen Y consumers could create their own “bank of the future” time machine to help guide them through their increasingly complex financial decisions, what would they create? How would that differ from bankers’ ideas? More technology? More mobile apps? More integrated asset management?

Andrea Simon PhD poses these questions in her recent article, “Gen X and Gen Y Consumers Yearn for Relationship-based Investment Programs,” just published by Independent Banker.

Financial services firms everywhere would certainly love to know, she observes, as they scramble to find ways to win the potentially massive business of the upcoming generation of financial consumers. Dr. Simon’s firm, Simon Associates Management Consultants (SAMC), recently conducted ethnographic research among members of Gen X and Gen Y, and found that consumers did not necessarily want high-tech solutions in isolation, but rather, support, advice and more knowledgeable people speaking to them than they currently experience in their banking interactions.

To understand better how Gen Xs and Gen Ys think about their emerging wealth and core financial concerns, SAMC asked a dozen middle-income consumers, mostly between the ages of 35 to 50, to envision an imaginary future bank that would best serve their personal financial and investment needs. Everyone in the group had investable, liquid assets of more than $500,000.

To help these consumers articulate their vision for the preeminent bank of the future, SAMC used very specific problem-solving games and collaborative play to tap into new, innovative thinking.

One theme that kept emerging from the conversations was that banking is still a people-to-people business, and that what these younger people wanted most was someone to guide them through their life transitions—from earning money to saving it, investing it, inheriting it and, finally, enjoying it, all the while having peace of mind that someone they could trust was guiding them and watching over their finances.

Here’s what Gen Xs and Gen Ys imagined future financial service providers could give them:

- a way to get back to the kind of bank where they felt they “belonged,” a place that had the knowledge and advice they were looking for;

- a place that could educate them on how to best protect their assets and use them wisely; and

- a guide that could help them design a sound budget and a workable plan for an uncertain future.

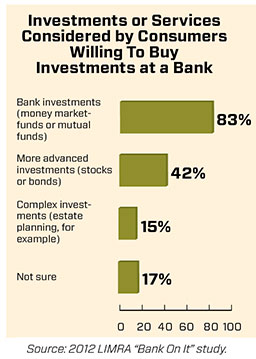

They wanted to feel appreciated, not like a number or an account. And perhaps most significantly for community banks with personal wealth management programs, Dr. Simon found that this generation of investors is far more willing to buy an investment product from a bank—75 percent compared with 63 percent of baby boomers, according to the 2012 LIMRA “Bank On It” consumer study. A similar pattern emerges when asked about buying life insurance.

This is very good news to relationship-based community banks that develop retail investment programs, Dr. Simon states, but they must still continue to offer what their institutions have always provided to consumers.

To read Dr. Simon’s Independent Banker article in its entirety, please click here.