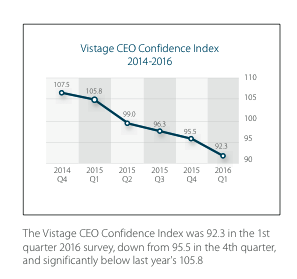

Each year, Vistage International, a peer-to-peer executive coaching organization, surveys its 20,000 members. The survey tells us a great deal about how they see the economy, overall, and their own businesses in particular. This last survey reaffirms the trends we have all been watching since 2014. CEOs are optimistic about their own business but losing confidence in the larger economy.

I wish I could segment this index based on the parts of the country where I speak to Vistage groups and look more closely at the root causes of their malaise. For some companies and their industries it is cyclical. Many others are coping with things that are transforming American culture.

Let me share with you some of our experiences, perspectives and what I will call the “trends from the trenches.” As a corporate anthropologist I like to search for the meaning in the data and tell the stories that hopefully make that data come alive.

No Doubt — Oil and Gas Industries are Hurting

You could look at the Houston companies and others that have been severely impacted by the oil and gas crisis. They are having a difficult time reinventing themselves. Some are finding new markets for their gauges or services or data capturing systems. Others are waiting for the industry to recover. One CEO asked why they always seem to follow the “herd” and rise and fall with the cycles. Great question. But he sort of already knew the answer — that “herd” mentality is hard to buck. There is some great research on the topic here.

What’s Happening Elsewhere?

These are very different from companies that have to find new, innovative ways to build their businesses in sectors that have little to do with oil or gas. Some of these are struggling. They are often unrelated industries facing similar changes with high levels of frustration. For example, real estate brokers and insurance companies, rental car companies and parking garages are watching things change for reasons that have much more to do with new life styles than with recurring business cycles.

What am I seeing in the field?

Trends from the Trenches

My view from the field is that these are fast changing times. The stress being dealt with by CEOs of mid-market companies should not be underestimated. Here are some of the challenges being faced in disconnected industries.

- I spoke not long ago to real estate brokers at their annual meeting about how to find their Blue Ocean Strategy. They were “angry.” Their anger is from their inability to deal with major changes in when and how people are getting married, buying homes and needing real estate brokerage services. Young people aren’t getting married at 25 anymore. They are waiting until their mid- or even late thirties. Instead

, they share apartments, renting rooms, and enjoying their freedom. Couples might live together. They are happily living in cities. These are often up-and-coming 18-hour cities such as Austin, Charlotte, or Denver with there is a lot of action but not the density of a New York — and rental prices are still affordable.

, they share apartments, renting rooms, and enjoying their freedom. Couples might live together. They are happily living in cities. These are often up-and-coming 18-hour cities such as Austin, Charlotte, or Denver with there is a lot of action but not the density of a New York — and rental prices are still affordable. - The spin from this, apart from the frustrated broker, is that they are not buying insurance. A prospective insurance company we spoke with was “angry.” This recurrent theme of anger was what we found so interesting. Their anger was from the same culture patterns of younger adults who were not getting married and buying homes. They also weren’t buying cars. Uber and Lyft were just as good if not better solutions for them. So, they weren’t buying insurance either. Rental insurance, sometimes. No need for car insurance or home insurance or life insurance. And, they were shopping online for product and pricing before they ever met with an agent.

- For both real estate brokers and insurance agents the online shopping was painful. In some cases people were getting their real estate licenses online and then joining new-style brokerage firms that charged a flat fee, not a percentage of commissions. The role of the traditional and well-established brokerage firm was being challenged, and they were fighting the changes not adapting to them. Of course, there was Zillow challenging the entire role that the broker played. Add to that the varied ways to buy insurance, and you can see how a lot of people were being impacted by the major changes in American culture.

Transformative Changes!

These weren’t just momentary or cyclical. These were transforming the “way we do things.” Our culture.

Add to that the rather broad frustration that companies are feeling — often their HR departments — about how to attract, retain and manage those Gen Y or Millennial adults, and you can begin to witness a “sea change” in optimism. Since we are expecting over 50% of the workforce to be these Millennials by 2020, we probably are going to see that confidence index struggling as the older CEOs try and adapt to their future employees and consumers.

In one group I was speaking to, for example, a CEO was simply venting that he had to buy a ping pong table and a barbecue for his 35-year old staffers who told him that they didn’t take smoking breaks. No. They just liked to relax over ping pong.

These are not the only stories to share.

Using my own experiences, I travel almost every week to a new city for business. Yet, I rent fewer and fewer cars. Uber works just fine. I am not sure if the Hertz folks realize my changing behaviors and how it is going to impact them, yet.

Another spin on this is from the president of a parking garage company in California. He was telling me that he knows what is happening. He was moaning about how people were using Uber and therefore not parking in his garage. He had leased out a floor to ZipCars because he had empty spaces. Zipcars, Uber, and how many other platform businesses are transforming other business models. Who is aware of what is happening and its impact on their revenue streams?

That Vistage CEO Confidence Index Report is a Must Read

You might want to read the entire Vistage Confidence Index Report. Some of the other highlights are below. My thanks to Elisa Spain, a great Vistage chair for her blog post on these points.

- 54% of CEOs plan to expand their workforce in the year ahead.u

- 32% of CEOs said the single most important issue they faced was finding, training, and retaining employees.

- 41% of CEOs plan to increase spending in new plant and equipment, the lowest level in three years.

- 70% of CEOs expect increased revenues in the year ahead, and 55% of CEOs expect increased profits

Our Speaking

We do a great deal of speaking for CEOs in Vistage, The Executive Committee (TEC) and other leadership groups on, among others:

- “Change Matters: How to Find Your New Market Space” (our Blue Ocean Strategy workshop)

- “Who Will Be Your Customer in Three Years”

- “Innovation: the Back and the Front End of Change”

You can see a sample of our workshops here.

Let us know if you would like to engage us to do your keynote address or a more in-depth workshop.

Andi Simon

President

Simon Associates Management Consultants

www.andisimon.com

asimon@simonassociates.net